Are you considering upgrading from an HDB flat to a condominium? Congratulations, you’re about to embark on an exciting journey towards a more luxurious and comfortable living experience. But before you dive into the world of condominium living, there are a few important things you need to know. In this ultimate guide, we’ll walk you through everything you need to consider and understand when making the transition. From understanding the financial implications to exploring the benefits of condo living, we’ve got you covered. Discover the key differences between HDB flats and condominiums, learn about the various financing options available, and get insider tips on finding the perfect condo for your needs. Whether you’re a first-time buyer or a seasoned homeowner, this guide will provide you with the knowledge and insights you need to make a well-informed decision. So, let’s get started on your journey to upgrading from an HDB to a condominium!

Understanding the Difference Between HDB and Condominiums

When considering an upgrade from an HDB flat to a condominium, it’s important to understand the key differences between these two types of housing. HDB flats are public housing units in Singapore, managed and developed by the Housing and Development Board (HDB). Condominiums, on the other hand, are private residential properties that offer a wide range of facilities and amenities. While both options provide housing, there are several factors that set them apart.

Firstly, ownership differs between HDB flats and condominiums. HDB flats are leased from the government for a fixed period of 99 years, while condominiums are owned outright by individuals or corporations. This means that when you purchase a condominium, you are buying a share of the property and have the freedom to sell or rent it out as you please.

Secondly, condominiums offer a more luxurious and exclusive living experience compared to HDB flats. Condos often come with a range of shared facilities such as swimming pools, gyms, and function rooms, which are not typically available in HDB developments. Additionally, condominiums are usually located in prime areas with easy access to amenities like shopping malls, restaurants, and parks.

Lastly, the price difference between HDB flats and condominiums can be significant. HDB flats are generally more affordable compared to condominiums, making them a popular choice for first-time homebuyers or those on a tighter budget. However, with the added luxury and amenities that come with condominium living, the higher price tag might be worth considering for those seeking a higher standard of living.

Reasons to Upgrade from HDB to a Condominium

There are several compelling reasons why upgrading from an HDB flat to a condominium might be the right choice for you. Firstly, condominiums offer a higher level of privacy compared to HDB flats. With fewer units per floor and better soundproofing, you can enjoy a quieter and more peaceful living environment.

Secondly, condominiums provide a wide range of facilities and amenities that can enhance your quality of life. From swimming pools and fitness centers to BBQ pits and playgrounds, these shared facilities offer a convenient and enjoyable lifestyle right at your doorstep. Additionally, many condominiums have 24-hour security, giving you peace of mind and a greater sense of safety.

Thirdly, upgrading to a condominium can be a smart financial move. Over time, condominiums tend to appreciate in value at a faster rate compared to HDB flats. This means that if you decide to sell your condo in the future, you may be able to earn a higher return on your investment. Additionally, owning a condominium gives you more flexibility in terms of renting out the unit, allowing you to generate passive income if desired.

Financial Considerations When Upgrading

When upgrading from an HDB flat to a condominium, it’s important to carefully consider the financial implications. Firstly, you need to determine your budget and how much you can afford to spend on a condominium. Take into account factors such as your current income, savings, and any existing loans or financial commitments.

Once you have a budget in mind, it’s time to explore the various financing options available. Condominiums can be financed through bank loans, housing loans, or a combination of both. It’s important to compare interest rates, loan terms, and repayment options to find the best financing solution for your needs. Additionally, consider consulting with a financial advisor to ensure you make a well-informed decision.

Another important financial consideration is the additional costs associated with owning a condominium. These can include monthly maintenance fees, property taxes, and sinking fund contributions. Take these expenses into account when budgeting for your upgrade to ensure you can comfortably afford the ongoing costs of condo living.

Finding the Right Condominium: Location, Amenities, and Facilities

When upgrading from an HDB flat to a condominium, finding the right property is crucial. There are several factors to consider when searching for the perfect condo for your needs.

Firstly, location is key. Consider factors such as proximity to your workplace, schools, public transportation, and amenities like shopping malls and parks. A well-located condominium can enhance your convenience and quality of life.

Next, take a look at the amenities and facilities offered by the condominium. Do you value a swimming pool, a gym, or a playground? Consider your lifestyle and preferences to ensure the condo you choose aligns with your needs.

Additionally, it’s important to research the reputation and track record of the developer. Look for developers with a proven track record of delivering high-quality projects and excellent customer service. This will give you peace of mind knowing that you’re investing in a well-built and well-maintained property.

Researching the Property Market and Prices

Before making your upgrade from an HDB flat to a condominium, it’s essential to research the property market and prices. This will help you make an informed decision and ensure you get the best value for your money.

Start by researching recent property transactions in the area you’re interested in. This will give you an idea of the current market prices and trends. You can access this information through online property portals or by consulting with a real estate agent.

Additionally, consider engaging the services of a property valuer to get an independent assessment of the property’s value. This will help you determine whether the asking price is fair and whether there is room for negotiation.

Lastly, keep an eye on upcoming property launches and new developments. Buying a property during the pre-launch or early stages of development can sometimes offer better deals and discounts.

Financing Options for Upgrading

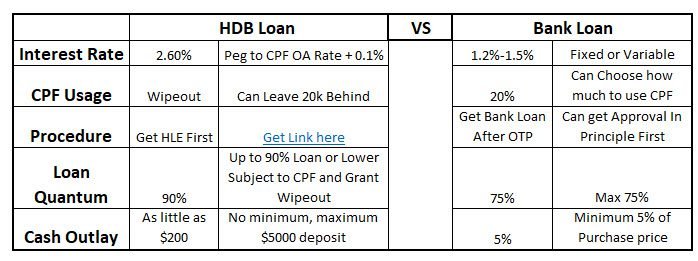

When upgrading from an HDB flat to a condominium, there are several financing options available to you. It’s important to explore these options and choose the one that best suits your financial situation.

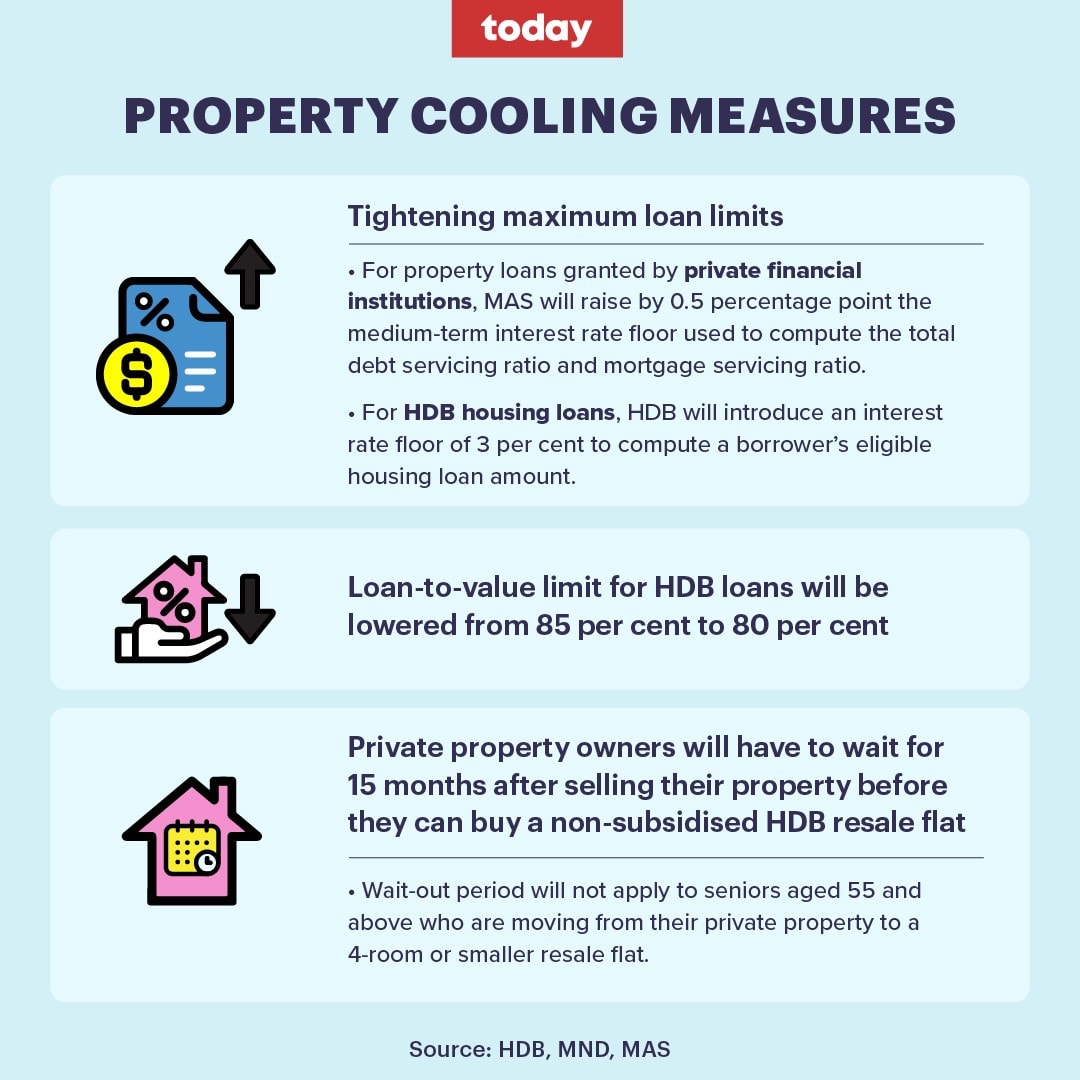

One common financing option is a bank loan. Banks offer competitive interest rates and flexible repayment terms, making them an attractive choice for many homebuyers. However, keep in mind that bank loans typically require a higher down payment compared to HDB loans.

Another option is an HDB loan. If you meet the eligibility criteria, you can apply for an HDB housing loan to finance your condominium purchase. HDB loans generally have lower interest rates and more relaxed eligibility requirements compared to bank loans. However, they also have certain limitations, such as a maximum loan tenure of 25 years.

You can also consider a combination of bank and HDB loans. This allows you to take advantage of the lower interest rates offered by HDB loans while benefiting from the flexibility of a bank loan.

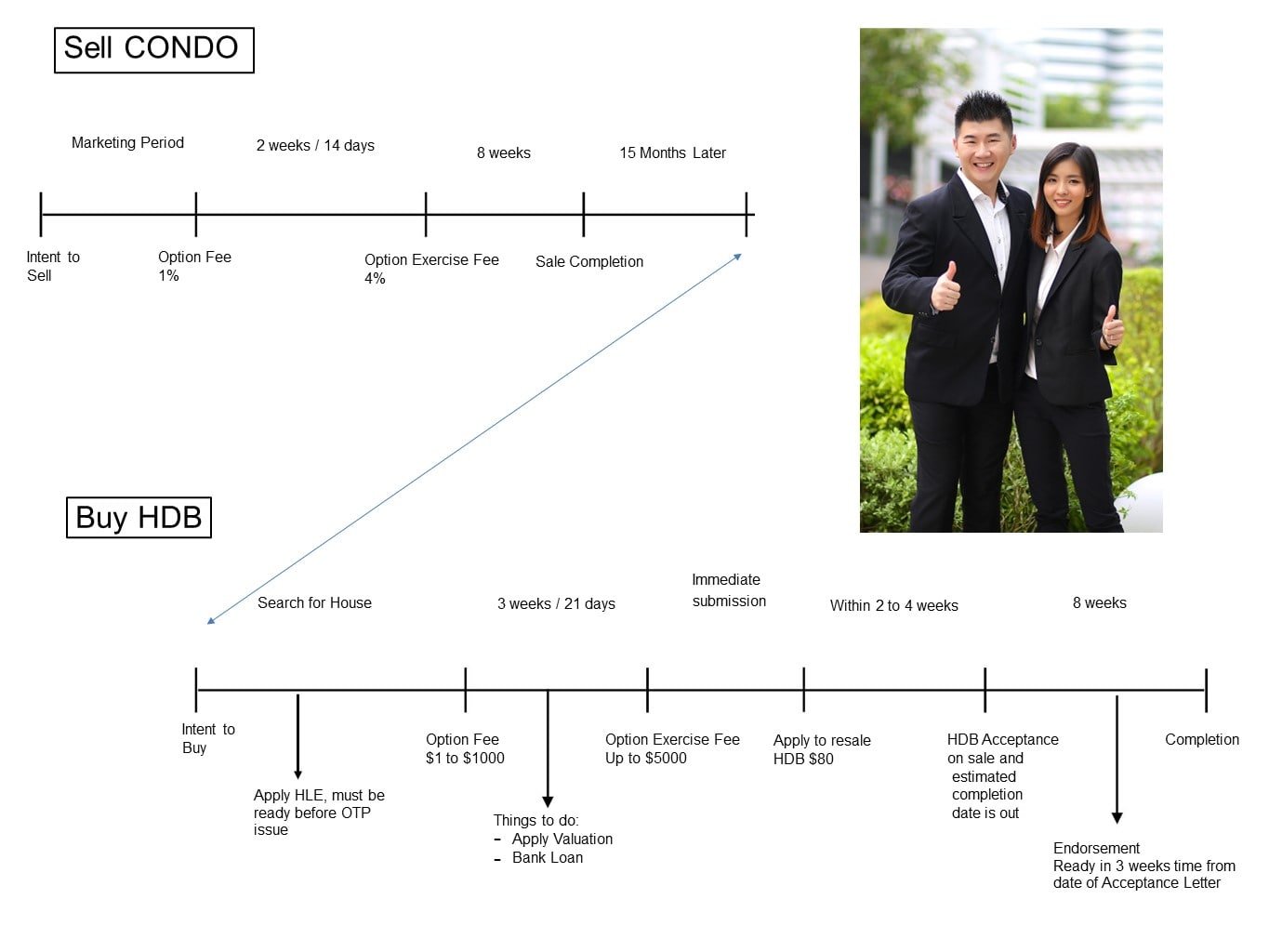

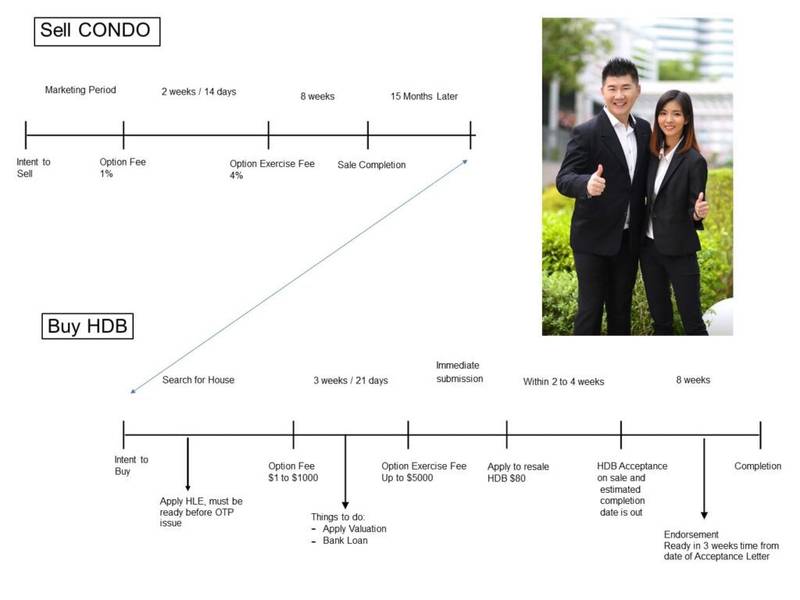

Selling Your HDB Flat: Process and Considerations

When upgrading from an HDB flat to a condominium, you’ll need to sell your existing HDB flat. This process can be complex, so it’s important to understand the steps involved and the considerations to keep in mind.

Firstly, engage the services of a trusted real estate agent who specializes in HDB resale transactions. They will guide you through the process, help you set the right asking price, and market your flat to potential buyers.

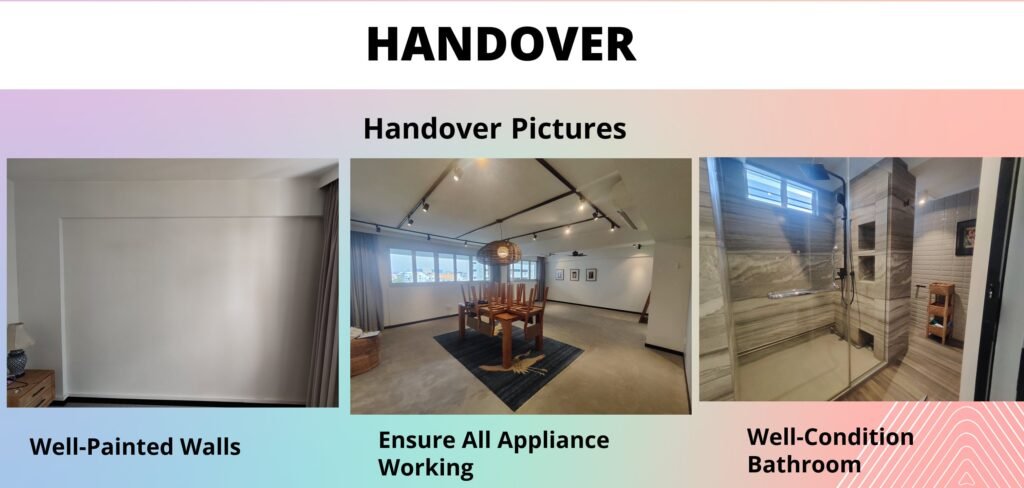

Before putting your HDB flat on the market, make sure it’s in good condition. Consider making any necessary repairs or renovations to enhance its appeal. Additionally, gather all the required documents such as the valuation report, floor plan, and recent property tax statement.

When negotiating with potential buyers, be prepared to consider factors such as the selling price, the timeline for completion, and any conditions or requests from the buyer. Your real estate agent will help you negotiate the best deal and ensure a smooth transaction.

Once you’ve successfully sold your HDB flat, you can use the proceeds to finance your upgrade to a condominium. Remember to consult with a financial advisor to ensure you make the most of your sale proceeds and make wise financial decisions.

Legal and Administrative Considerations When Upgrading

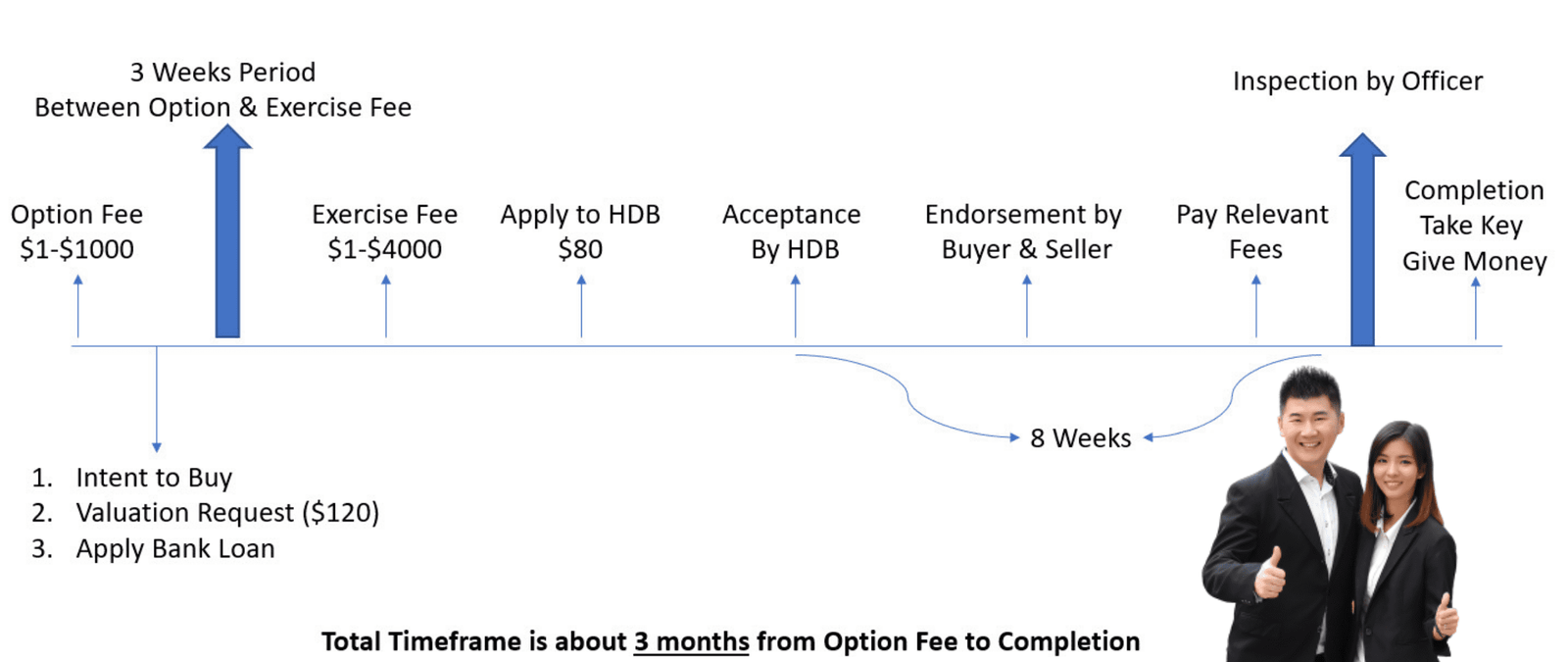

When upgrading from an HDB flat to a condominium, there are several legal and administrative considerations to keep in mind. These include the application process, eligibility criteria, and documentation requirements.

Firstly, you’ll need to submit an application to purchase a condominium. This involves completing a set of forms and providing supporting documents such as your NRIC, proof of income, and proof of residency. The developer or the sales team will guide you through the application process and provide you with the necessary forms.

Additionally, ensure you meet the eligibility criteria set by the government and the developer. These criteria can include factors such as citizenship, income level, and ownership of other properties. Make sure to check the eligibility requirements before committing to a purchase.

During the purchase process, you’ll also need to engage a lawyer to handle the legal aspects of the transaction. They will review the sales and purchase agreement, conduct property searches, and ensure a smooth transfer of ownership.

Lastly, consider engaging the services of a professional interior designer or renovation contractor to help you transform your new condominium into your dream home. They will work with you to create a design concept, source for materials, and oversee the renovation process.

Moving from HDB to a Condominium: Tips and Checklist

Moving from an HDB flat to a condominium can be an exciting but challenging process. To ensure a smooth transition, here are some tips and a checklist to help you along the way.

1. Plan your move in advance: Create a timeline and schedule for your move, taking into account factors such as renovation completion, handover of keys, and moving logistics.

2. Declutter and organize: Before packing, take the opportunity to declutter and get rid of any items you no longer need or want. This will make the moving process more efficient and help you start fresh in your new home.

3. Pack strategically: Pack your belongings systematically, labeling each box with its contents and the room it belongs to. This will make unpacking and setting up your new home much easier.

4. Arrange for utilities and services: Contact utility providers such as electricity, water, and internet to arrange for the transfer of services to your new condominium. Additionally, inform relevant parties such as banks, government agencies, and subscriptions about your change of address.

5. Hire professional movers: Consider hiring professional movers to handle the logistics of your move. They will ensure your belongings are safely transported to your new home, saving you time and effort.

6. Set up your new home: Once you’ve moved into your new condominium, take the time to set up your home and make it comfortable. Unpack your belongings, arrange furniture, and personalize the space to reflect your style and preferences.

Common Challenges and Pitfalls When Upgrading

While upgrading from an HDB flat to a condominium can be a rewarding experience, it’s important to be aware of common challenges and pitfalls that may arise along the way. By understanding these challenges, you can better prepare and mitigate any potential issues.

One common challenge is the higher financial commitment associated with condominium living. In addition to the higher purchase price, you’ll need to consider ongoing expenses such as monthly maintenance fees, property taxes, and sinking fund contributions. Make sure to factor these costs into your budget to avoid any financial strain.

Another challenge is the longer waiting time for new condominium projects. If you’re purchasing a new development, be prepared for the possibility of delays in completion and handover. This can affect your moving timeline and plans, so it’s important to have contingency plans in place.

Lastly, be aware of the potential impact on your lifestyle and daily routines. Condominium living may come with certain rules and regulations that you need to adhere to. This can include restrictions on pet ownership, noise levels, and renovation works. Make sure to familiarize yourself with the condominium’s by-laws and regulations to ensure a smooth transition.

Conclusion: Is Upgrading from HDB to a Condominium Right for You?

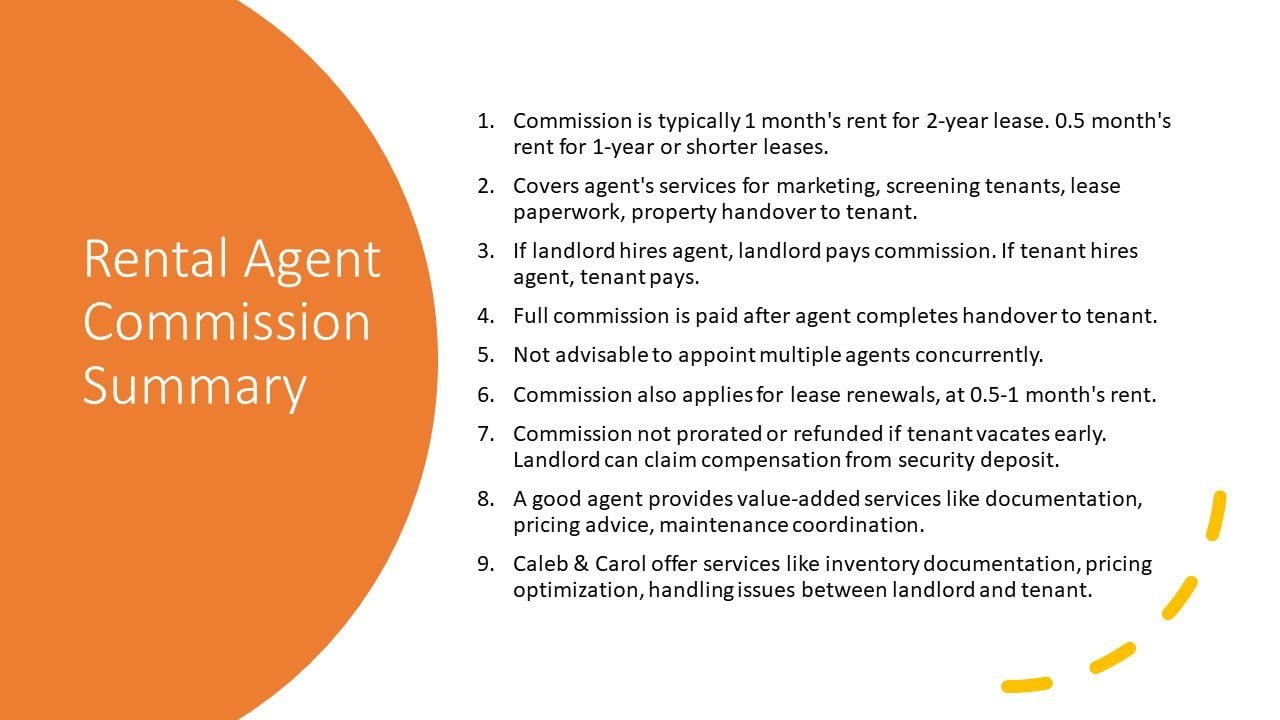

Upgrading from an HDB flat to a condominium is an exciting journey, but it can also be complex and overwhelming. With the right guidance and support, however, you can navigate this transition smoothly and confidently. That’s where I, Caleb Seah, your trusted real estate agent, come in.

As an experienced professional in the real estate industry, I understand the ins and outs of the HDB-to-condominium upgrade process. I am well-versed in the key differences between HDB flats and condominiums, the financial considerations involved, and the various financing options available. I can help you explore the property market, analyze prices, and negotiate the best deal for your dream condominium.

By choosing me as your real estate agent, you’ll benefit from my extensive knowledge of the market, access to a wide network of resources, and my commitment to delivering exceptional service. I will work closely with you to understand your needs, preferences, and budget, ensuring that we find the perfect condominium that meets your requirements.

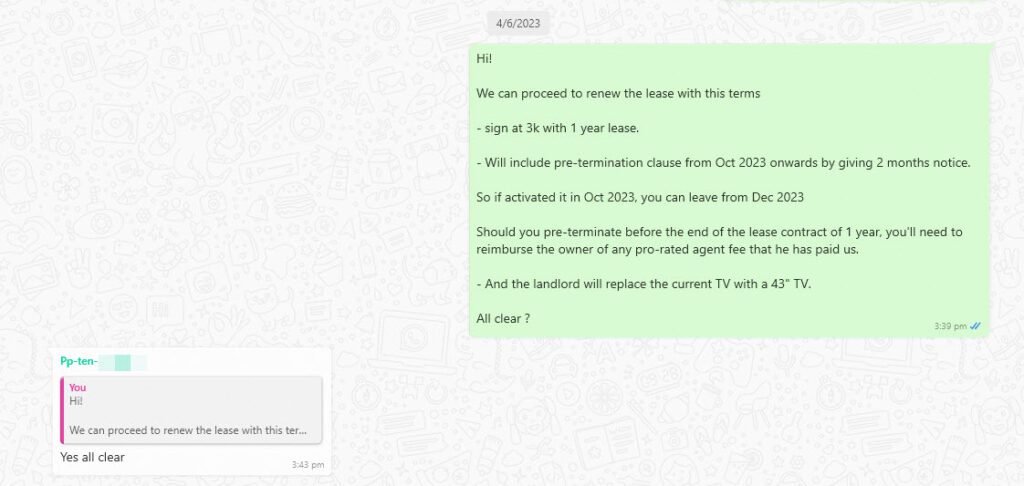

Throughout the entire journey, I will be by your side, offering valuable insights, handling legal and administrative processes, and providing guidance on property valuations, financing options, and the selling of your HDB flat. With my expertise and attention to detail, I will make sure you are well-informed at every step, making the upgrade process hassle-free and rewarding for you.

Whatsapp us to find out more on how we are able to help you today!