Before you start on your journey to buying the first HDB that you've been looking for, you need to be looking into this 3 areas before going into:

1) Loan

2) Housing Grants

3) Funds breakdown

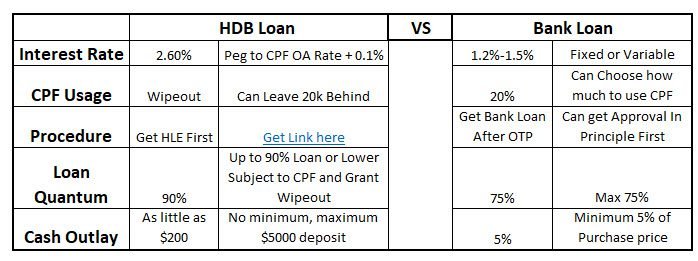

HDB vs Bank Loan

When it comes to HDB loan, the interest rate is higher than bank loans. It's peg to your CPF OA's rate at 0.1% above it. Therefore, most HDB Loans is at 2.6%. Whereas for bank loan rate, it's at 1.2% - 1.5% you have the option to choose between taking a fixed rate or floating rate. DBS rates now is 1.5% for 2 or 3 or 5 years fixed.

For CPF usage, HDB Loan will require you to wipe out your entire CPF OA rate. They will also allow you to set aside $20,000 each in your Ordinary Account. Buyers who take up bank loan will usually need to come up with 20% of the purchase price with CPF. However they have the options of not wiping out their entire CPF OA.

For HDB Loan quantum, they are able to get up 90% of the purchase price to be used. Whereas for bank loans they are only able to take up maximum of 75% of the purchase price.

On another attractive aspect is that HDB Loan, you do not need to come out with much cash for your purchase. However for Bank loan, you'll need to come out with at least 5% of the purchase price. Thus if you were to buy $500,000 HDB flat, you'll need to come out with $25,000 in cash.

Housing Grants

CPF Housing Grants

Depending on the type of property you buy, the grants will differ.

Should you be looking at 4 Room flat and below your CPF housing grant will be $50,000.

Should you be looking at 5 Room flat and above your CPF housing grant will be $40,000.

CPF Enhanced Housing Grants

Enhanced CPF Housing Grants will be dependent on the household combined income for the last 12 months.

Proximity Housing Grants

To be eligible for proximity housing grants, You'll either need to live within 4km from parent's house or stay together with your parents.

If you stay within 4km, you'll be entitled $20,000 grant.

If you choose to live with your parents, you'll be entitled $30,000 grant.

Should your parents currently own a premise, they'll need to undertake to sell that property within 6 months after you have collected your keys.

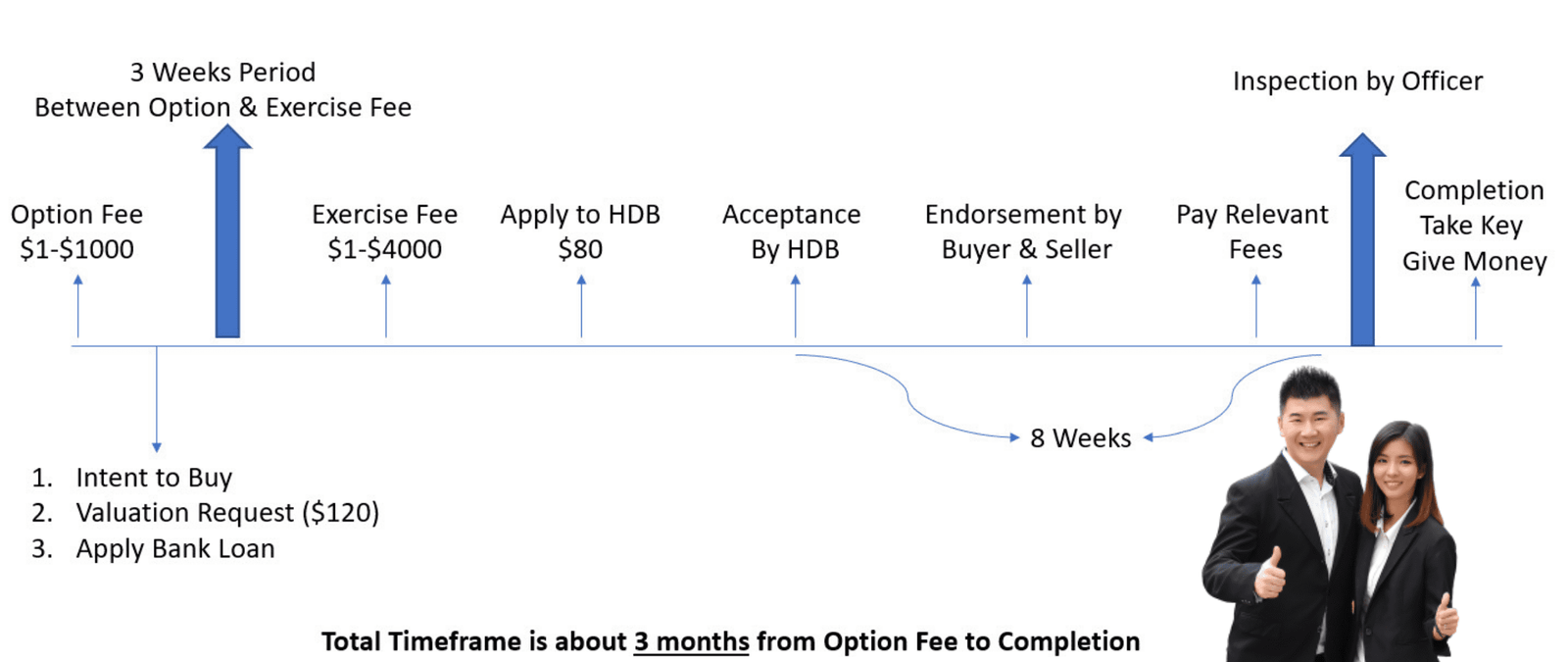

Timeline For HDB Purchase

When you have decided to buy your property, you'll need to go through different phases of a property purchase.

- Pay Option Fee $1-$1000

- Do an Intent to Buy

- Apply for Valuation Request $120

- Apply for Bank Loan (If Getting Bank Loan)

- Exercise Your Option to Purchase ($1-$4000)

- Apply to HDB ($80)

- Acceptance by HDB

- Endorsement by Buyer & Seller

- Pay Relevant Fees

- Inspection by Buyer

- Completion, Take Key & Give Money

Should you have any questions with regards to buying your first HDB, do drop me a call at Caleb 91085690 today!